If you have been watching the Fairfax County market and feeling like everything moves faster than you can keep up, you are not alone.

It can feel discouraging to see new listings pop up and wonder if you missed your chance.

You might be asking yourself whether prices are still holding firm or if buyers are finally getting breathing room.

You may also be trying to figure out if there is any real inventory to choose from right now.

This snapshot is meant to help you feel grounded with a clear look at what is actually showing up in the market.

[Fairfax County Single Family Home Market Snapshot from Bright MLS]

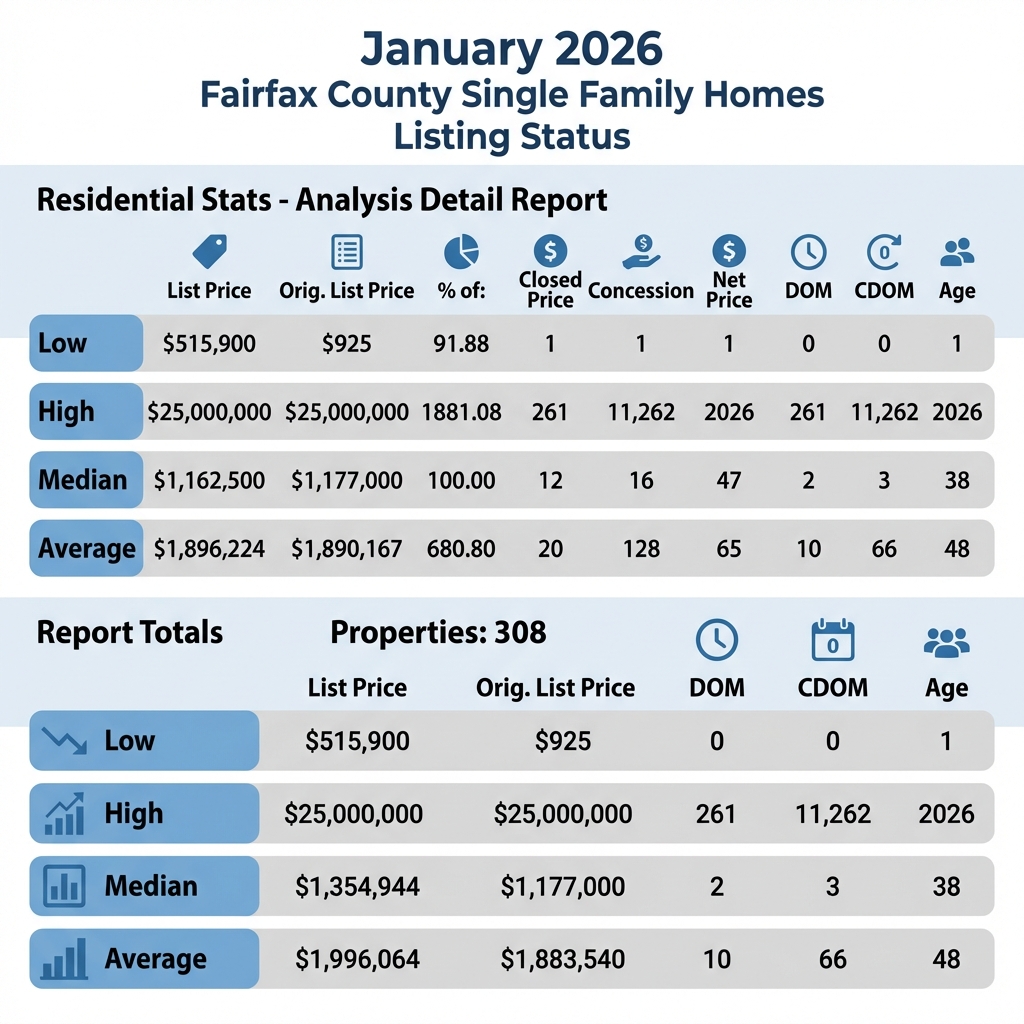

This market snapshot is based on a BRIGHT MLS, generated on January 26, 2026. It focuses on Fairfax County, Virginia single family homes that have been added since January 1, 2026, and it separates them into “Coming Soon” and “Active” listings.

In just the first 26 days of the year, the report shows 150 coming soon listings and 158 active listings, for a total of 308 single family homes entering the pipeline. The overall picture points to fresh inventory, very limited price reductions, and low days on market for most properties.

[Key Market Numbers You Can Use]

For the coming soon category, there were 150 listings with a median list price of $1,587,445 and an average list price of $2,101,229. The price range ran from $565,000 to $17.2 million. The median age shown in the report was 29 days.

For the active category, there were 158 listings. The report did not provide a single median or average list price for active listings, though sample pricing in the data suggests a range that may land around the $1.2 million to $1.5 million level. The active price range ran from $599,000 to $25 million. Days on market for many active listings clustered in the one to 20 day range, while a small number of properties showed much older cumulative days on market, including one example at 11,262 CDOM.

[Coming Soon Listings: Confidence and Few Price Changes]

One of the clearest takeaways from the coming soon group is how firm pricing appears to be. Nearly all properties in this category were positioned at 100 percent of their original list price, with reductions showing up only in rare cases.

The high end of the market is also very visible here. A standout example is 612 Rivercrest Dr listed at $17.2 million with 18 days shown. The report also includes new construction lot offerings such as Peniwill Dr parcels around $1.5 million.

At the same time, most of the coming soon inventory sits in a broad middle band from about $600,000 to $2 million, which often signals that sellers believe early year demand will be strong enough to support their pricing.

[Active Listings: Fresh Inventory with a Few Outliers]

The active side looks similarly firm overall. Most active listings were still holding at 100 percent of list price, and the reductions that did appear were modest. Examples in the report include 1543 Youngs Point Pl at 97 percent and 7113 Falcon St at 98 percent.

The pace of new inventory is also notable. Many active listings show very low days on market, often between one and 20 days, which suggests that a large share of what buyers are seeing is newly introduced rather than stale carryover.

Still, there are always exceptions, and the report includes long term listings as well. One extreme example is 11273 A Waples Mill Rd showing 11,262 CDOM. Those outliers matter because they can distort perception. A buyer might think “everything is sitting,” when the reality is that most of the market is turning quickly while a handful of listings linger for specific reasons.

At the very top end, the active group peaks with 1100 Crest Ln listed at $25 million.

[Luxury Homes Are Driving a Big Part of Early Year Momentum]

If you have been wondering whether high end demand is still present going into 2026, this report suggests it is. The coming soon list alone includes more than 20 properties priced over $3 million, with examples such as $6.5 million on Herbert Springs Rd and $5.5 million on Arbor Ln.

That does not automatically mean every luxury property will sell quickly, but it does show that sellers at the top end are bringing inventory to market early in the year, and that is a meaningful signal about confidence and expected buyer activity.

[Entry Level Options Still Exist, But They Are Limited]

Even in a market that leans luxury, the report shows there are still some lower priced opportunities. On the coming soon side, 3727 West Ox Rd appears at $565,000. On the active side, 4803 Valley St appears at $599,000.

For buyers looking closer to the entry level range, the key challenge is usually selection and competition rather than simply finding any listing at all. When inventory is fresh and pricing is firm, well priced homes can attract attention quickly.

[What the Low Rate of Price Reductions May Be Telling Us]

Across both groups, only about five percent of listings show price cuts in the report. That is a small share, and it usually points to stable pricing expectations rather than widespread seller urgency.

It also fits with the story told by days on market. Coming soon listings are essentially at the starting line, and many active listings are extremely new. When a market is dominated by fresh listings, you often see fewer reductions because sellers are still testing demand at their preferred price points.

The report also mentions that some local analyses have forecast continued strength for single family homes in 2026, including a median sales price increase of about 1.9 percent year over year. Forecasts can vary, but the early year listing behavior shown here does look consistent with a market that is not bracing for steep discounts.

[How to Use This Snapshot If You Are Buying or Selling]

If you are a buyer, pay close attention to days on market and whether a listing is truly new versus simply carrying a long cumulative history. In a fast moving environment, timing and preparation matter, especially in popular neighborhoods and price bands.

If you are a seller, this snapshot reinforces that early year inventory is showing up with confidence and limited reductions. Pricing and presentation still matter, but the broader tone of the market, especially in the luxury segment, looks active based on the volume and firmness reflected here.

If you want help interpreting what these Fairfax County single family home market numbers mean for your specific neighborhood or price range, feel free to reach out. I am happy to talk through your situation and help you build a plan that fits your timeline, whether you are buying, selling, or just trying to understand what you are seeing online.

It can feel discouraging to see new listings pop up and wonder if you missed your chance.

You might be asking yourself whether prices are still holding firm or if buyers are finally getting breathing room.

You may also be trying to figure out if there is any real inventory to choose from right now.

This snapshot is meant to help you feel grounded with a clear look at what is actually showing up in the market.

[Fairfax County Single Family Home Market Snapshot from Bright MLS]

This market snapshot is based on a BRIGHT MLS, generated on January 26, 2026. It focuses on Fairfax County, Virginia single family homes that have been added since January 1, 2026, and it separates them into “Coming Soon” and “Active” listings.

In just the first 26 days of the year, the report shows 150 coming soon listings and 158 active listings, for a total of 308 single family homes entering the pipeline. The overall picture points to fresh inventory, very limited price reductions, and low days on market for most properties.

[Key Market Numbers You Can Use]

For the coming soon category, there were 150 listings with a median list price of $1,587,445 and an average list price of $2,101,229. The price range ran from $565,000 to $17.2 million. The median age shown in the report was 29 days.

For the active category, there were 158 listings. The report did not provide a single median or average list price for active listings, though sample pricing in the data suggests a range that may land around the $1.2 million to $1.5 million level. The active price range ran from $599,000 to $25 million. Days on market for many active listings clustered in the one to 20 day range, while a small number of properties showed much older cumulative days on market, including one example at 11,262 CDOM.

[Coming Soon Listings: Confidence and Few Price Changes]

One of the clearest takeaways from the coming soon group is how firm pricing appears to be. Nearly all properties in this category were positioned at 100 percent of their original list price, with reductions showing up only in rare cases.

The high end of the market is also very visible here. A standout example is 612 Rivercrest Dr listed at $17.2 million with 18 days shown. The report also includes new construction lot offerings such as Peniwill Dr parcels around $1.5 million.

At the same time, most of the coming soon inventory sits in a broad middle band from about $600,000 to $2 million, which often signals that sellers believe early year demand will be strong enough to support their pricing.

[Active Listings: Fresh Inventory with a Few Outliers]

The active side looks similarly firm overall. Most active listings were still holding at 100 percent of list price, and the reductions that did appear were modest. Examples in the report include 1543 Youngs Point Pl at 97 percent and 7113 Falcon St at 98 percent.

The pace of new inventory is also notable. Many active listings show very low days on market, often between one and 20 days, which suggests that a large share of what buyers are seeing is newly introduced rather than stale carryover.

Still, there are always exceptions, and the report includes long term listings as well. One extreme example is 11273 A Waples Mill Rd showing 11,262 CDOM. Those outliers matter because they can distort perception. A buyer might think “everything is sitting,” when the reality is that most of the market is turning quickly while a handful of listings linger for specific reasons.

At the very top end, the active group peaks with 1100 Crest Ln listed at $25 million.

[Luxury Homes Are Driving a Big Part of Early Year Momentum]

If you have been wondering whether high end demand is still present going into 2026, this report suggests it is. The coming soon list alone includes more than 20 properties priced over $3 million, with examples such as $6.5 million on Herbert Springs Rd and $5.5 million on Arbor Ln.

That does not automatically mean every luxury property will sell quickly, but it does show that sellers at the top end are bringing inventory to market early in the year, and that is a meaningful signal about confidence and expected buyer activity.

[Entry Level Options Still Exist, But They Are Limited]

Even in a market that leans luxury, the report shows there are still some lower priced opportunities. On the coming soon side, 3727 West Ox Rd appears at $565,000. On the active side, 4803 Valley St appears at $599,000.

For buyers looking closer to the entry level range, the key challenge is usually selection and competition rather than simply finding any listing at all. When inventory is fresh and pricing is firm, well priced homes can attract attention quickly.

[What the Low Rate of Price Reductions May Be Telling Us]

Across both groups, only about five percent of listings show price cuts in the report. That is a small share, and it usually points to stable pricing expectations rather than widespread seller urgency.

It also fits with the story told by days on market. Coming soon listings are essentially at the starting line, and many active listings are extremely new. When a market is dominated by fresh listings, you often see fewer reductions because sellers are still testing demand at their preferred price points.

The report also mentions that some local analyses have forecast continued strength for single family homes in 2026, including a median sales price increase of about 1.9 percent year over year. Forecasts can vary, but the early year listing behavior shown here does look consistent with a market that is not bracing for steep discounts.

[How to Use This Snapshot If You Are Buying or Selling]

If you are a buyer, pay close attention to days on market and whether a listing is truly new versus simply carrying a long cumulative history. In a fast moving environment, timing and preparation matter, especially in popular neighborhoods and price bands.

If you are a seller, this snapshot reinforces that early year inventory is showing up with confidence and limited reductions. Pricing and presentation still matter, but the broader tone of the market, especially in the luxury segment, looks active based on the volume and firmness reflected here.

If you want help interpreting what these Fairfax County single family home market numbers mean for your specific neighborhood or price range, feel free to reach out. I am happy to talk through your situation and help you build a plan that fits your timeline, whether you are buying, selling, or just trying to understand what you are seeing online.

"If you have been watching the Fairfax County market and feeling like everything moves faster than you can keep up, you a..."

.jpeg)

.jpg)

.jpg)